Misclassifying business travel for temporary workers in Europe

Across Europe, businesses are becoming more dependent on cross-border travel, short-term assignments and temporary labour. While this flexibility supports growth, it also exposes clients and their supply chains to significant tax risks when business trips are misclassified, or tax relief is incorrectly applied to temporary workers.

Business Travel under European tax principles

Although each EU member state has its own tax legislation, European tax authorities apply consistent principles when determining if business trips qualify for tax relief. The emphasis is on substance over form.

Business travel expenses wrongfully reimbursed tax-free will be reclassified as taxable remuneration and liabilities incurred.

When the end client becomes the permanent place of work

A critical and often misunderstood risk arises where workers supply their services exclusively to a single end client (hirer) for a temporary assignment or contract. In these circumstances, European tax authorities may treat the end client’s premises as the worker’s permanent place of work, even if the worker is engaged via an agency, umbrella company or other intermediary.

This assessment typically considers:

• Exclusivity of service – If the worker provides services only to one hirer over a sustained period, the client location may be regarded as their habitual or permanent workplace.

• Economic and organisational integration – Where the worker is embedded into the hirer’s business — using their systems, working alongside employees and contributing to core activities.

• Duration and expectation – Rolling or open-ended assignments, or engagements that are extended repeatedly, undermine the argument that the workplace is temporary.

• Absence of genuine multi-site working – Where travel is simply from their home, or the accommodation they are staying in for the contract, to the hirer’s site. This is deemed a general commute to a single place of work rather than between multiple client locations. Therefore, tax authorities are unlikely to accept that travel qualifies for tax relief or tax free reimbursement.

In these cases, the fact that the worker is formally employed or contracted elsewhere does not prevent the hirer’s site from being treated as the permanent workplace for tax purposes.

Temporary workers and intermediary structures

European tax authorities are increasingly sceptical of structures designed to preserve tax relief that do not reflect working reality. Agency and umbrella arrangements do not prevent a permanent workplace from arising.

Authorities will typically assess:

• Who determines where, when, and how the work is performed.

• Whether the worker is economically dependent on one hirer.

• Whether the assignment resembles a de facto permanent role.

Where the facts support permanence, tax relief will be denied regardless of contractual wording.

Tax consequences of permanent workplace reclassification

If the end client is deemed to be the permanent place of work:

• Home-to-work travel becomes ordinary commuting, not business travel.

• Travel and subsistence expenses become taxable, and any tax-free reimbursement may need to be repaid.

• Temporary Accommodation costs become taxable, and any tax-free reimbursement may need to be repaid.

• Payroll withholding obligations may arise, potentially exposing the engaging entity to tax and social security liabilities.

• Historic claims may be challenged, often on a retrospective basis.

Crucially, liability may extend beyond the intermediary and fall on the end client, particularly where the client exercises control over working patterns or has influenced how reliefs are applied.

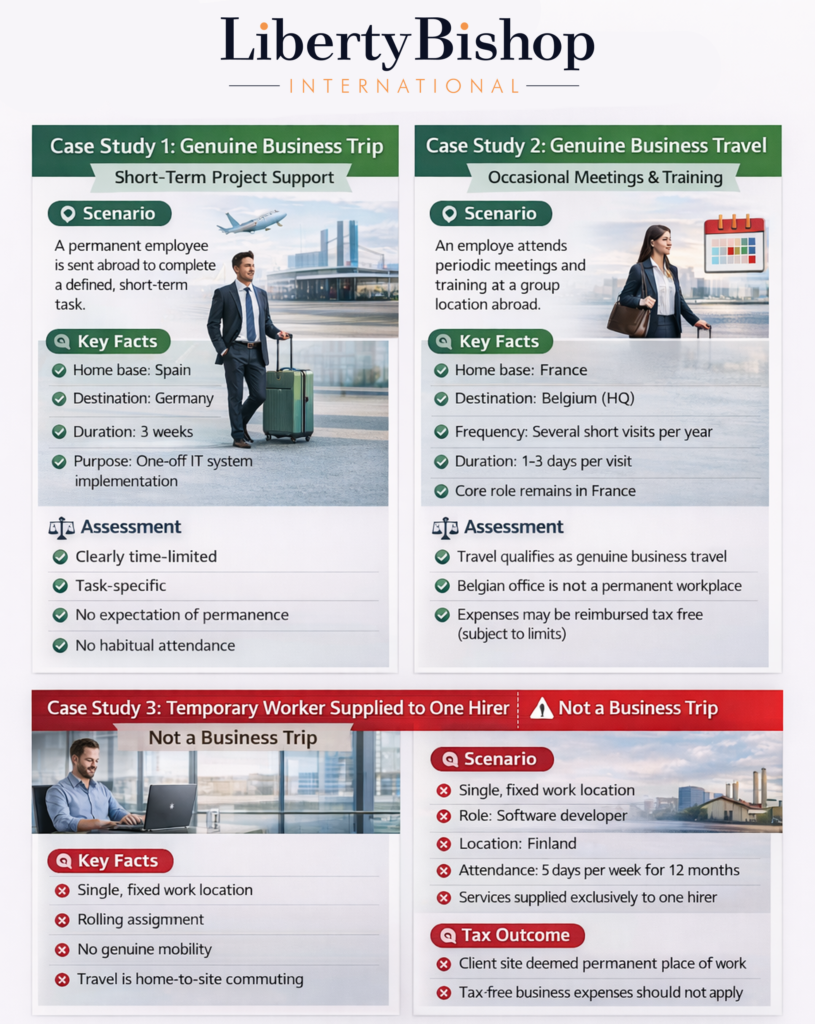

See below for a some example scenarios outlining genuine business trips.